I said a few months ago that spending restraint would begin to flow through the economy because interest rates would absorb more household income – ergo, less money in your pocket to spend. Fast forward three months, things are a bit clearer, and in my view, a trend change is underway.

Tony Alexander is a renowned Economics Analyst and Commentator in New Zealand. Key findings from his monthly ‘spending intentions’ surveys over the last six months are;

- Discretionary spending will fall on things like – cars, furniture, appliances, technology, travel.

- Supermarket spend will increase – still gotta feed the family though, so must be done.

- The number of people looking to upgrade to a new home is in the negative.

- Spending on home renovations was flat but is now negative

- Property investors have been absent for over 12 months

The squeeze is well and truly on. For example, a local favourite grocer of mine had to close his doors and I wasn’t surprised. Unfortunately, I don’t think it’ll get much better in the New Year either. But there are strategies to use during this time…

Strategy #1: The ins and outs

This one will require some effort – stopping and taking note of what’s coming in. You need to know exactly what income you have. Then, really understand where it’s going – what are you spending your money on? This is not meant to be judgemental; it’s creating awareness. When you start recognising the problems, only then can you begin to address them. It comes back to the saying “knowledge is power” and once you have knowledge about the ins and outs of your money, you have more control.

In fact, we have a whizzy online tool that connects to your online banking and categorises your spending over the previous 6 months. It is the ultimate in transparency and can help uncover a range of things where you can improve or tighten up. As a client, we can provide access to this tool for free. Please ask us about it.

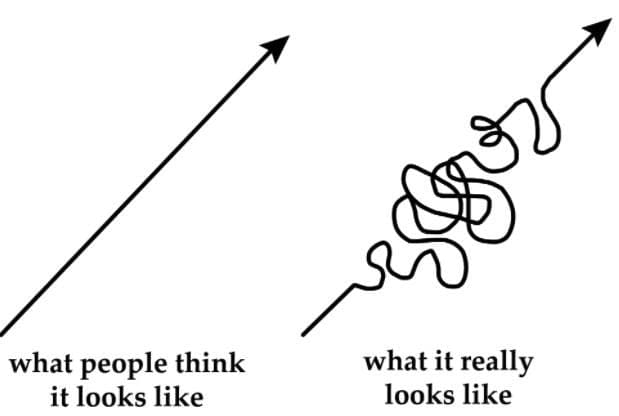

Strategy #2: The direction

This one is a follow-on from strategy number one.

If you understand what your goals and priorities are then you’ll probably spend your money in a way that aligns with those things. The opposite is true too and if you feel like you just fritter money away then a lack of goals could well be the underlying problem.

When I say ‘goals’ I don’t necessarily mean you have to aim for something earth-shattering, there’s no need to conquer the world. It could be as simple as planning a 3-week family holiday that’ll cost $10,000. That’s a great goal that everyone can get behind, but it might be difficult to achieve if you’re frittering money away on other stuff. See, the alignment is what matters.

Hence our offer to provide transparency over your actual spending.

Strategy #3: mortgage in bits

Most of our clients are already doing this, it’s a winning strategy to help you sleep better at night, particularly if you are always worried about interest rates.

Split your mortgage into bits, usually two or three bits. Each bit will have a different interest rate and be on a different term (length of time). This strategy is used to spread your risk – so when interest rates move (which they have been a lot of the last twelve months) the increase and higher payments will only affect one of the ‘bits’.

You can’t avoid increases, they happen, but when you combine a split with fixed interest rates you get the best of both worlds – some certainty, time to adjust your budget, and your risk is spread out over time.

Follow these strategies and we’re positive you’ll make it through this squeeze period in really good shape. Feel free to get in touch to use our whizzy tool and take out half the work for you.