As with all forecasts and predictions, a grain of salt is necessary to answer that question. In the case of interest rate forecasts, a wheelbarrow of salt is probably prudent! But if you were to push me, then I’d say yes, I think they have. We won’t know until we are at least six months beyond the peak, but I reckon we’re sitting right on it now.

Indicators that inform my prediction

- The first is that in December 2022, the official measure of inflation was 7.2%. Fast forward to March 2023 and that had reduced to 6.7%. It’s not a huge change but I’m looking for the direction rather than the speed of change. I won’t be surprised if the next inflation report (July 2023) shows something in the low 6% range, but it should be lower. It’s a fact that there is a connection between inflation and interest rates so keep an eye on this number.

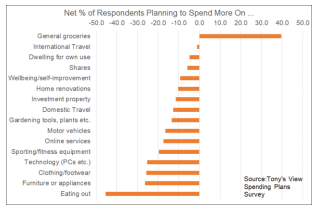

2. The second comes from Tony Alexander’s spending intentions survey which shows that the spending restraint that started in 2021 is well entrenched for all parts of the economy. The notable exception is grocery spending which makes sense. The news is not good for retailers but will be welcomed by the Reserve Bank of New Zealand (RBNZ) because it tells them that their efforts to crush inflation (with higher interest rates) are working and are having a broad impact.

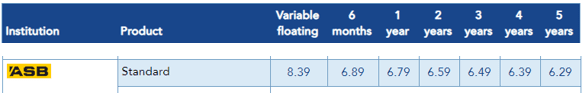

3. The third was one I highlighted several months ago which is the fact that all the longer-term fixed interest rates are lower than the shorter-term fixed interest rates. In other words, the money markets see interest rates being lower in the future. For example, here’s what ASB is offering right now – see?

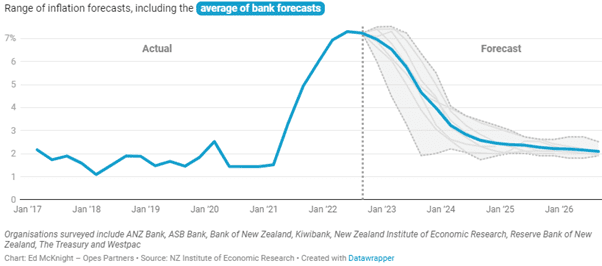

4. A fourth comes from the below graph from the good folk at Opes Partners which aggregates the inflation forecasts of ANZ, ASB, BNZ and KiwiBank. It shows that the banks see inflation easing back into the RBNZ’s target range by the end of January 2024.

This last graph from Opes is interesting (pun intended) because it helps explain why we are recommending people continue to fix their interest rates but not for too long. If these forecasts pan out, then inflation should be back within the RBNZ 1-3% range within the next two years and interest rates will follow suit. It follows that while going for a three-year fixed rate (or longer) looks cheap at the moment, doing so might mean you end up stuck paying more than you need to while rates are dropping.

Still, there is much uncertainty around and that’s why I say it’s prudent to have a wheelbarrow of salt on hand, and to look at the direction of travel rather than trying to pinpoint the actual numbers themselves or the exact date when things will change.

It’s also why we are great advocates of splitting your mortgage into several parts and having a different fixed interest term on each part. This spreads your risk and helps support a couple of different outcomes – one where interest rates improve quickly, another where they take longer to change – all while giving you a decent measure of certainty along the way.

The upshot of all this is that while there is still some pain to endure (and hence the previous article about looking closely at one’s own household budget, Kirsty and I certainly have) there is some light at the end of the tunnel. And if you just keep going, you’ll make it.