INCOME: Why quality’s (almost) more important than quantity right now

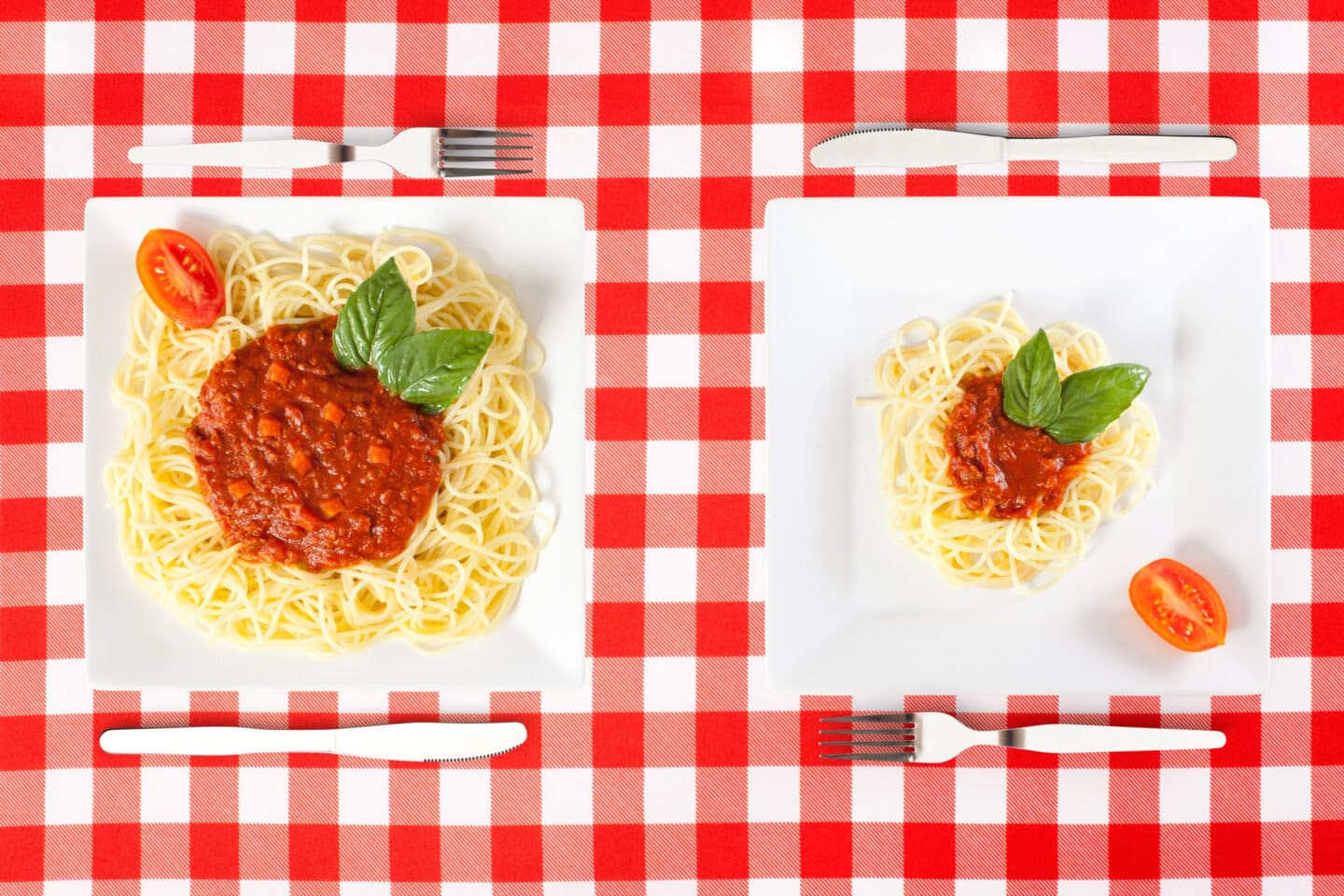

Bigger is better right? The more the merrier too?

In a financial context both make a lot of sense. When you think about borrowing money for a mortgage in the Auckland market, the more income you’ve got then the better your chances of getting that mortgage. That’s obvious.

However, the Covid-19 situation has brought one aspect of your income to light that you might not have thought about before. I don’t know what the bank calls it, but I call it income quality.

Quality – in an income sense – is all about how stable, consistent and reliable it is. Banks have always considered this aspect of your income, but it’s really easy to forget about quality when simply ‘having enough’ seems like the bigger hurdle. I get that.

The key to understanding the concept of income quality in a mortgage context is to remember that your mortgage payments are relentless. They will keep popping up every month for 20, 25 or 30 years. They will not let up.

It follows that getting a mortgage is not just about having ‘enough’ income, it’s about having income that keeps on coming. As in every month for 20, 25 or 30 years.

I know that no one can ever guarantee their income will be that reliable 100% of the time! Hell, the lockdown has shown that seemingly stable and permanent jobs can vanish overnight or be reduced in an instant.

But the lockdown has also shown that some income sources are definitely better than others. We instinctively know this and here it is, plain as day.

If I asked you to compare the income a nurse has against the income a real estate agent has, which one would you prefer?

- The unreliable but (sometimes) huge real estate agent income?

- Or the more modest but unlikely to ever stop income a nurse gets?

I can tell you the bank definitely prefers the latter. And it’s not because they hate real estate agents! No, it’s about certainty and reliability of one income compared to another.

Why do banks love lending to doctors? Because the income is about as good as it gets – big and reliable!

And now to the point of telling you all this: Like never before, new mortgage applicants are going to be asked to prove that the income you’ve got is rock solid. Self-employed people are going to find it much harder to borrow because previous business performance (and in turn your personal income) doesn’t have the reliability it used to. The same could be said if you’re someone who gets performance bonuses or commissions – they could well dry up for the next 12 months.

Let me really hammer the point home: I recently applied for a mortgage so I could buy another rental. The ASB guy said – Campbell, people won’t be buying houses, so they won’t be getting mortgages, so your commission will drop. Try again in the 2021 financial year. Decline. I shit you not!

I’m not about to go nursing, but it does prove the point! I’m just gonna wait it out till things improve.

That’s ok for me, but to those desperate to get into the market for the first time, it probably feels like a punch in the guts. Even if your income hasn’t changed over the Covid-19 period, banks will still be a little nit-picky about the stability of your income. They’re not only covering their butt, they’re covering yours too. Sometimes saying ‘No’ has to happen. If you’re a parent you (should!) know this well… ‘I’m saying NO for your own good’.

Don’t panic – they’re not going to say ‘No’ to everyone at all. But let’s just say, the bar will be set a little higher for a while.

What can you do about it? Well, first home buyers, understand that your income is the first thing they’ll look at.

- If you’re self-employed, understand your income stream, document it well and be prepared to answer questions about gaps. Especially the Covid-19 gap and how you plan to make up for it.

- If you’re not planning to buy in the next 6-months, think about how you could make your income more stable or appear more stable – can you move to a more permanent contract rather than just freelance, perhaps switch out of self-employment to in-house for a period if that’s possible.

- Could you move to a more stable field? Yep, it’s a big move… but worth consideration perhaps if home ownership is a real goal for you.

Every answer is going to be different. That said – don’t let it put you off home ownership – just prep well. Know what you could borrow and whether you’re in the ballpark with what you earn and how you earn it.

Want a bit of guidance – we’re here to talk, when you are.